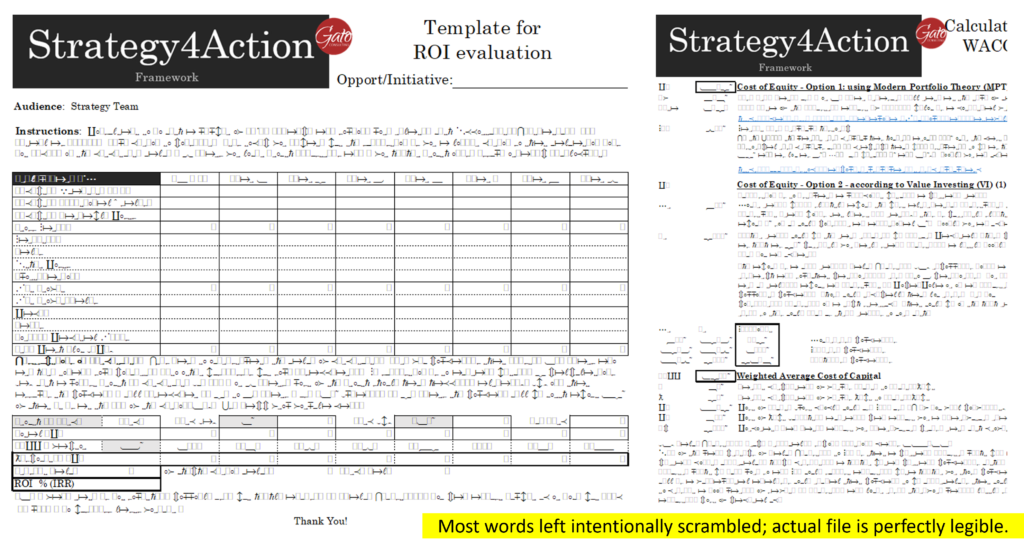

File includes 2 templates. This template is basically the same as template S4A3203 – Action: Financial – Template for producing a Discounted Cash Flow Valuation (DC) and determine Present Value; and template for determining the Weighted Average Cost of Capital (WACC). If you have that one, you don’t need this one. ROI is one of the main criteria to determine the validity of a Strategic Opportunity or Initiative (together with Strategic Fit and Feasibility). The first form is an ROI template. By the way it includes instructions for perpetuity including a brief reference on how to think about a fade rate. The second form has the formula for calculating the Weighted Average Cost of Capital (WACC). For the cost of equity component, it provides two methods: the most popular Modern Portfolio Theory and the schema proposed by Value Investing.

File format: compressed (zip) excel file, editable.

Buying this file entitles you to use it yourself and: a) If you work for a company or organization, you can use it for it and its subsidiaries; b) If you are a student, you can share it within your project-group or study-group; c) If you are a teacher, you can share it with your students. Everyone else may not share this file.